COVID-19's Impact on Farmer Livelihoods

[Surveys of participants in TechnoServe’s commercial agriculture programs in Benin, Brazil, Guatemala, India, Kenya, Nicaragua, Nigeria, Mexico, Mozambique, Uganda, Zimbabwe. Average sample size 683.]

Markets

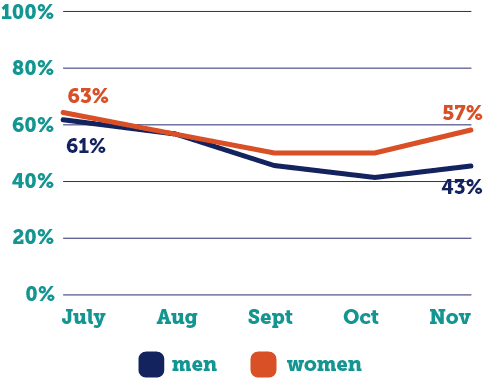

Market Challenges

Smallholder farmers faced significant challenges selling their crops in the first several months of the pandemic. While the situation improved towards the end of the year, nearly half of those who tried to sell their crops in November still reported problems.

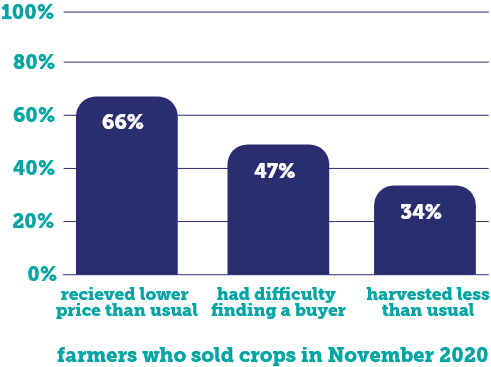

The two most common market challenges were low prices and difficulty finding a buyer. These related to coronavirus disruptions along the agricultural supply chain, stemming from earlier travel restrictions, supply shortages, and falling consumer demand. As a result, many market actors faced higher costs of doing business or even went out of business altogether. Farmers therefore struggled to find as many buyers as usual, with those remaining offering lower prices due to decreased competition and their own higher costs.

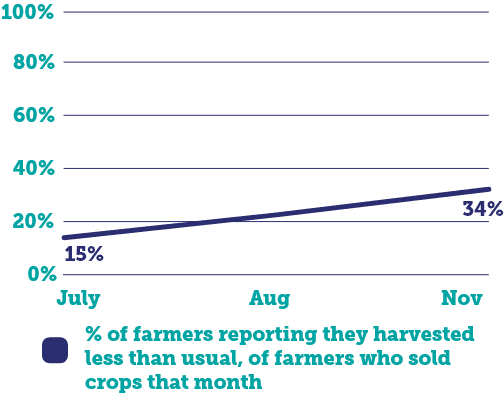

These problems plagued farmers at relatively consistent rates throughout most of last year—and caused roughly half of farmers, in surveys from July through November, to report that they were worse off financially than they had been at the same time last year. This led to a problem that intensified as the year progressed: low on cash and unable to invest as much in their farms, roughly one in three farmers reported harvesting a lower quantity of their crop than usual in November, a jump of 19 percentage points.

It’s a vicious cycle that threatens to continue—lower investment in farms leading to lower production, lower income, and further underinvestment—with potentially dire consequences for smallholder farmers.

Market Solutions

Survey results indicated that farmers who cultivated crops in supply chains supported by TechnoServe were less likely to experience market challenges. This may be related to the tendency of farmers to fare better in tighter, more organized supply chains, which characterize much of TechnoServe’s agricultural work.

As the coronavirus pandemic strained all manner of agricultural markets, TechnoServe worked to ensure that supply chains continued operating to the benefit of smallholder farmers. This required a response across the value chain: helping to calm jittery markets; establish new platforms connecting farmers and buyers; and support farmers in finding new buyers after pandemic-related market shifts.

Continued resilience of agricultural markets in the developing world will require ongoing support across the value chain, particularly for critical intermediaries like food processors and crop aggregators.

Below are examples of market solutions in commercial agriculture that proved effective this year:

Supply

Supply Challenges

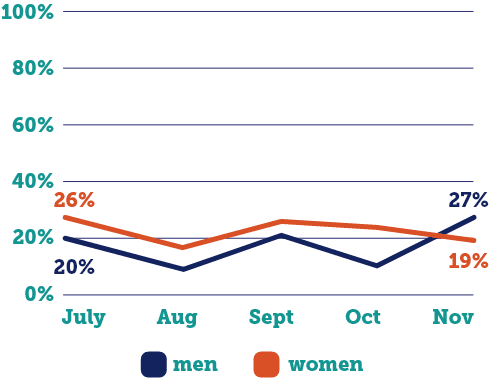

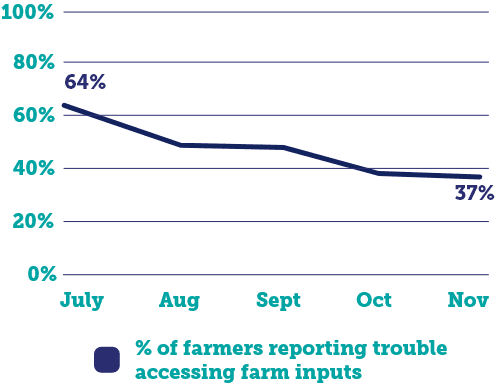

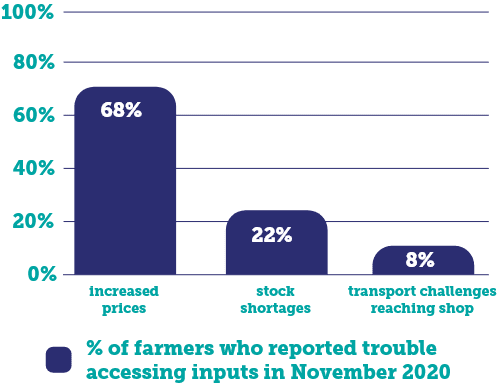

Pandemic-related supply chain disruptions affected not only farmers’ access to markets, but also their access to farm supplies such as seeds, fertilizer, and plowing equipment. Roughly 50-60% of farmers reported challenges accessing agricultural inputs in the middle of last year, with 37% continuing to experience problems as of November 2020.

Higher transport and business costs for input providers in the middle of the supply chain led to increased purchase prices for farmers, putting many supplies out of their reach. More than two in three farmers who experienced challenges accessing inputs cited high prices as a problem—a number that has remained steady from our first survey in July through the end of the year.

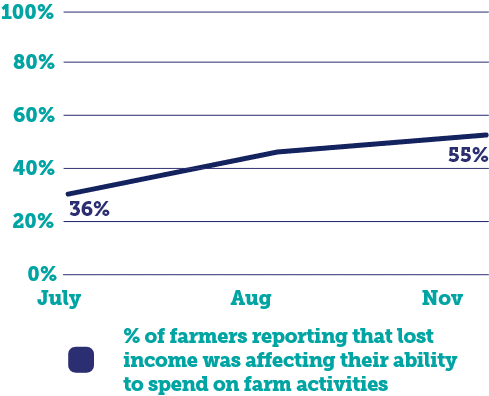

A growing number of farmers therefore had difficulty investing in their farms. In November, over half of farmers who reported income losses in the past month stated that it was affecting their ability to spend on their farms, an increase of nearly 20 percentage points since July. Coupled with declining income, input access challenges likely contributed to the share of farmers reporting lower-than-usual crop production jumping from 15% in July to 34% in November.

Supply Solutions

The market challenges that lowered farmers’ incomes also impacted their ability to purchase farm inputs. Much of TechnoServe’s work helping smallholder farmers find better buyers and prices therefore improved farmers’ ability to access the supplies they needed to invest in future crop production. Helping farmers obtain financing for inputs—either through financial institutions or arrangements with crop buyers—was also important.

Farmers in particularly remote areas had trouble getting enough inputs—or the inputs they did receive were too expensive or of poor quality. TechnoServe helped address this “last mile” distribution problem by applying methods for aggregating crops to aggregating input orders, providing input suppliers with an incentive to meet these larger orders, while maximizing farmers’ purchasing power.

Although transport and logistics disruptions may have complicated farmers’ efforts to obtain agricultural inputs, their pandemic-related financial losses will likely present the biggest challenge to their ability to adequately invest in their farms.

Below are examples of supply solutions in commercial agriculture that proved effective this year:

Finance

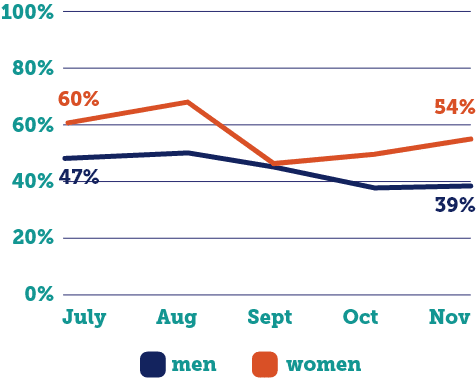

Finance Challenges

As farmers’ incomes dropped due to supply chain challenges, demand disruptions, and falling prices, they struggled to find ways to cope. Many ended up reducing their households’ food intake, while purchasing less expensive or less preferred foods. About a third tapped into their savings in order to get by.

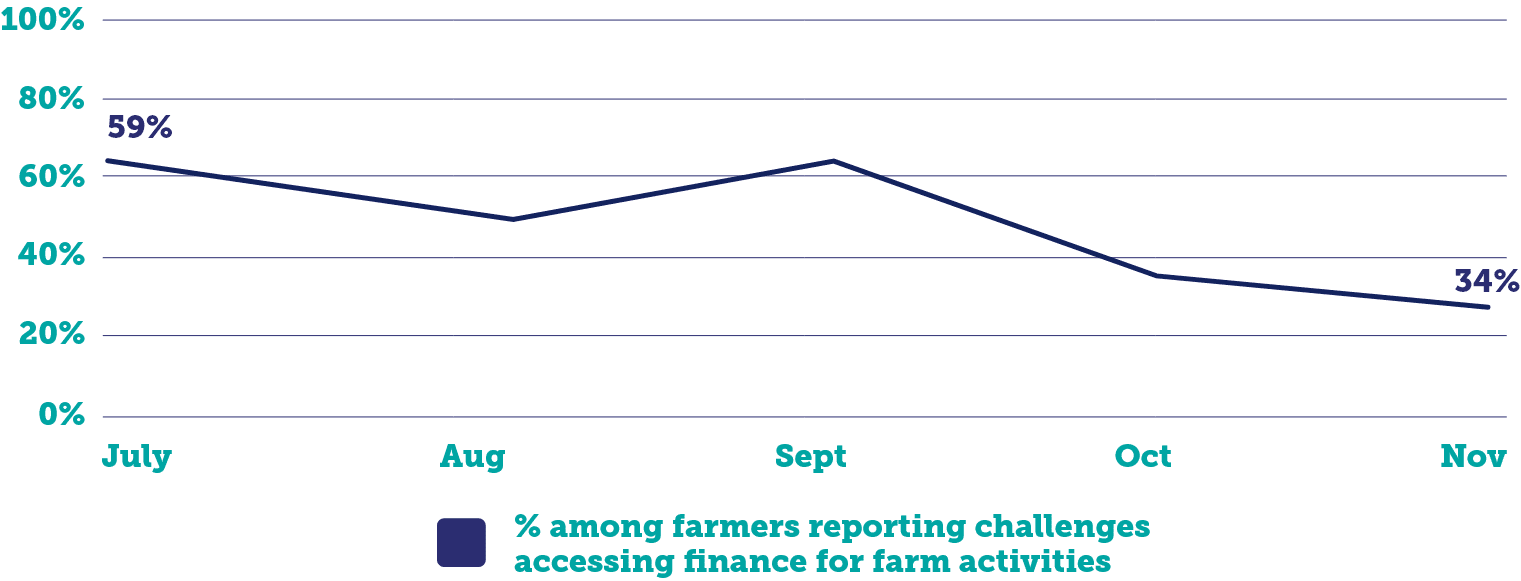

Smallholder farmers consistently reported trouble obtaining additional capital to help them through the hard times. Three out of five respondents had trouble accessing finance in July, and two out of five still struggled with the issue at the end of 2020. As banks and other financial institutions were themselves grappling with extended market uncertainty, they became more hesitant to provide loans and increase their own risk exposure. Meanwhile, other sources of income, such as side businesses, were also often affected by coronavirus disruptions.

Finance Solutions

Economic shocks affecting farmers will ultimately affect entire supply chains. For this reason, crop buyers can help improve supply chain resilience by supporting farmers through economic shocks like the one precipitated by the COVID-19 pandemic. Businesses that depend on smallholders for raw materials can provide increased credit or advance financing to ensure that these farmers are able to buy adequate inputs and continue to produce crops at a level that will enable them to support their families.

In India, for instance,TechnoServe helped farmer groups access capital through strategic partnerships with non-bank lenders and traditional financial institutions. It connected the directors of farmer groups with banking officials through video calls, to discuss loan requirements, business operations, and scale-up opportunities. TechnoServe then worked with the farmer groups to meet financing requirements, helping them update their financial records, develop business plans, and navigate the loan and disbursement process.

Through this process, 15 farmer groups were able to access over $400,000 in financing to help them overcome pandemic-related disruptions.

Coffee

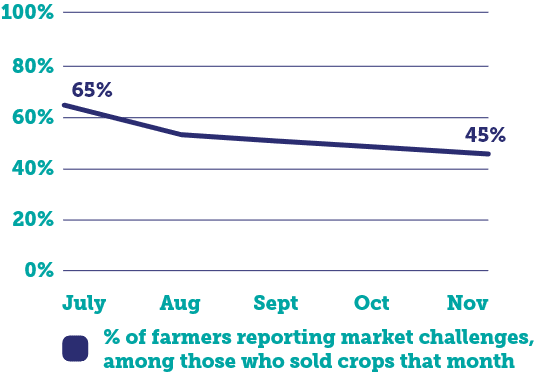

While most smallholder farmers were challenged by the COVID-19 crisis, the coffee sector was more insulated from some of the worst effects.

While most smallholder farmers were challenged by the COVID-19 crisis, the coffee sector was more insulated from some of the worst effects.

TechnoServe works with approximately 100,000 smallholder coffee farmers around the world due to the crop’s potential to significantly boost farmer incomes through improvements in quality and yields. As the pandemic bore down on farmers around the world, TechnoServe regularly surveyed coffee farmers across its programs (and partnered with the research firm Laterite on more in-depth surveys of East African farmers) to determine the impact of the pandemic and how best to provide support.

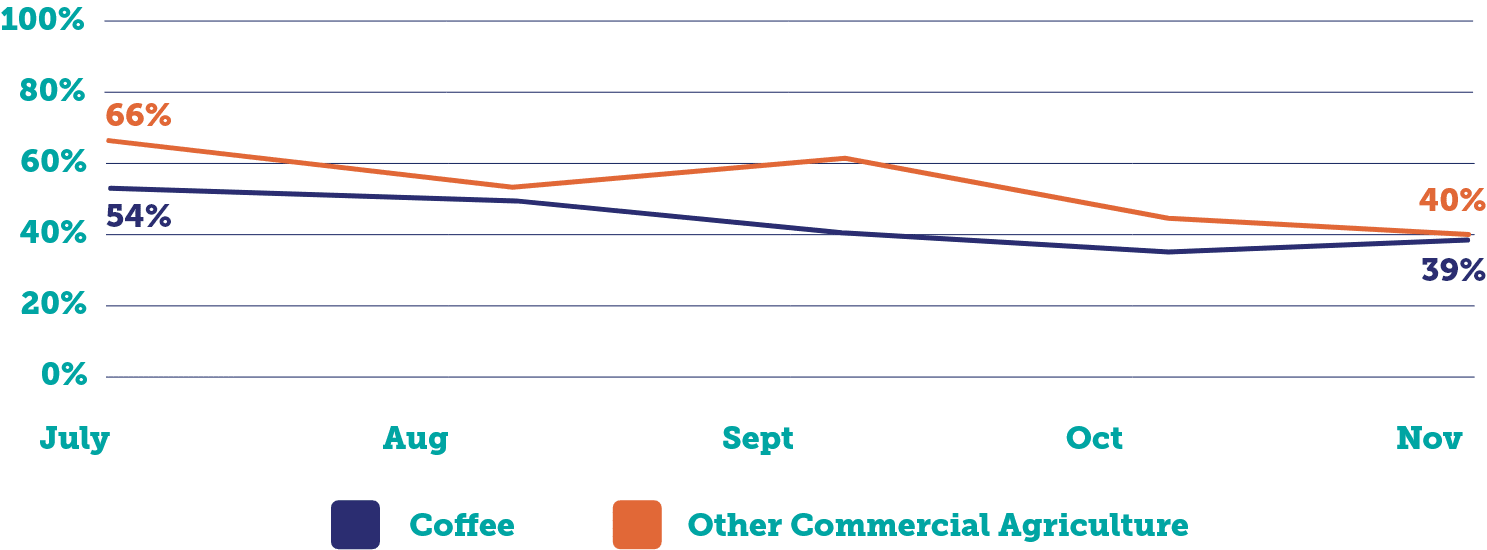

While geography, harvest seasons, and other factors played a role, it seemed that coffee farmers experienced less lost income from their coffee crops than from other income sources. Coffee farmers also reported fewer market challenges than did other farmers in TechnoServe’s programs (though coffee farmers do often grow other crops).

The relative resilience of coffee production may be due in part to the crop’s nonperishable nature, which makes it less vulnerable to the transportation delays that beset other sectors this past year. And coffee’s global price has rebounded in the last year, amid worldwide demand that remained stable during the pandemic.

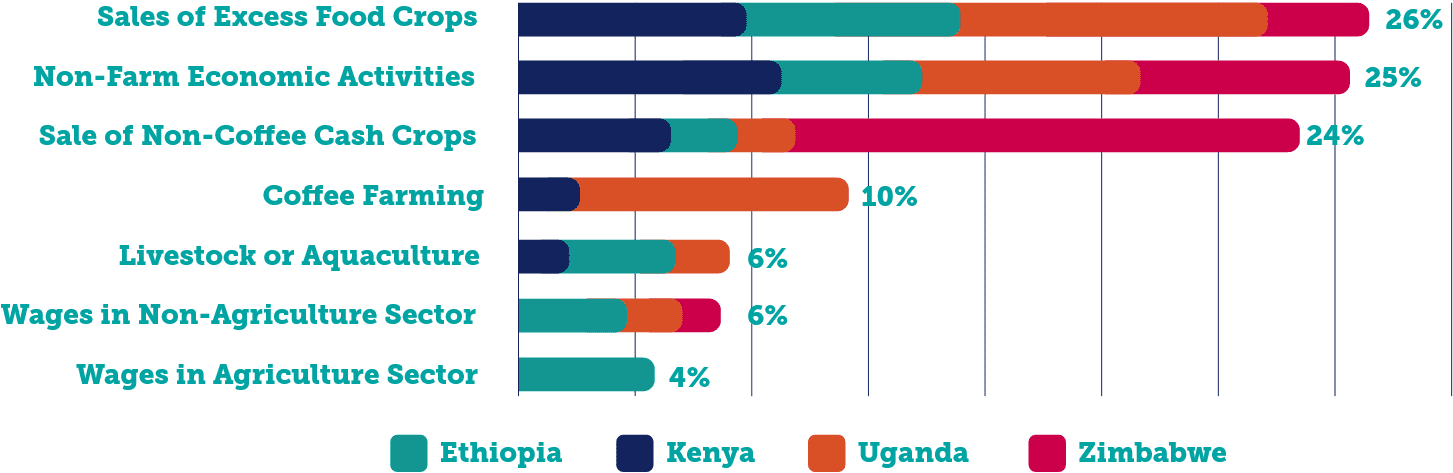

Coffee farmers did seem to experience similar input access challenges as other commercial farmers. And coffee farmers also depend on other sources of income, many of which were negatively affected by the coronavirus pandemic. Across the East African countries surveyed, most farmers cited losing income from the sale of excess food crops; financial activities off the farm (such as a side business); and sale of other cash crops besides coffee.

In Latin America, travel and social distancing restrictions prevented many coffee farmers from hiring enough workers in time for the harvest. In addition, many inexperienced workers began harvesting coffee for the first time, out of economic necessity. As a result, both the coffee quality and the amount harvested fell in many places across the region this past year.

Despite these challenges, adopting improved production practices remains a relatively reliable way for smallholder coffee farmers across the globe to safeguard their incomes during economic uncertainty.

“During these difficult times caused by the COVID-19 pandemic, I have been able to take care of my family comfortably because I had some savings from previous coffee sales…I am now determined to establish another coffee farm in the next few years [to prepare] for future uncertainties.”

– Teddy Nakyajja, coffee farmer (Uganda)