COVID-19's Impact on Small Business Owner Livelihoods

[Surveys of participants in TechnoServe’s entrepreneurship programs in Benin, Botswana, Chile, Cote d’Ivoire, El Salvador, Guatemala, Honduras, Kenya, Mexico, Mozambique, Nigeria, South Africa, Tanzania. Average sample size 738.]

Markets

Market Challenges

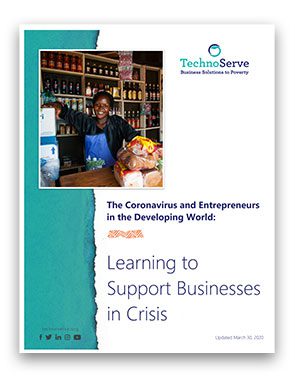

As countries around the globe enacted restrictions to stop the spread of the virus, many businesses had to make changes that significantly affected their sales: restricting business hours; limiting the number of customers they could serve; or even temporarily closing their doors. Consumers also altered their behavior, reducing the number and length of their shopping trips and shifting their buying preferences. In May 2020, TechnoServe found that 57% of micro-retailers surveyed in Africa reported sales as their greatest challenge.

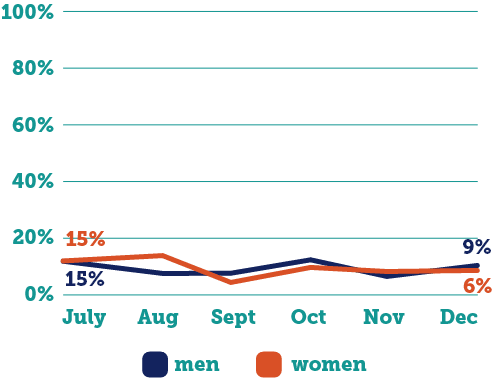

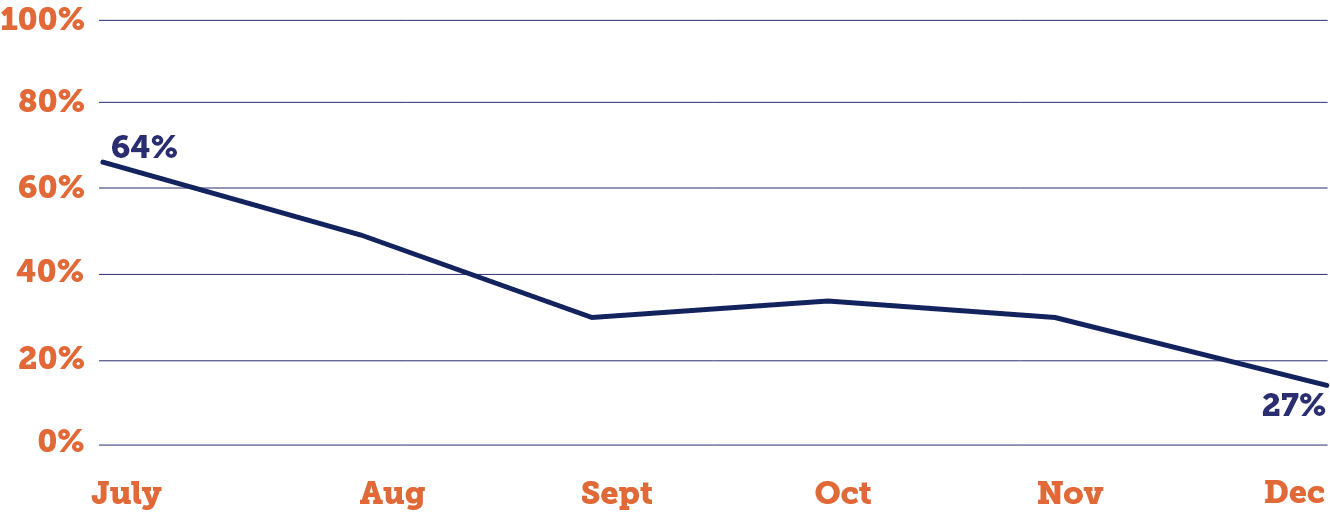

In a global survey a few months later, nearly two-thirds of small businesses reported COVID-related problems with customer demand. As the year progressed and social and travel restrictions eased and re-tightened in different countries, sales challenges largely decreased.

But at the close of 2020, nearly 30% of entrepreneurs still struggled with sales, and some sectors—especially those related to tourism and hospitality—face particularly acute challenges.

The first year of the coronavirus pandemic battered small businesses around the globe, and the ones still standing have learned to adapt—usually in leaner, less profitable form. But without sufficient sales, businesses will struggle to pay salaries and rent and may eventually risk shutting down entirely.

Market Solutions

For small enterprise owners suddenly flung into the middle of a volatile economic crisis, personalized business advice was a lifeline. With immediate coaching on how to adapt their business model and financial strategies, many entrepreneurs could pivot their business towards survival.

TechnoServe’s entrepreneurship programs employed a “crisis toolkit” developed from previous work supporting small businesses through acute economic problems. This eight-step approach helped entrepreneurs take stock of the situation, conduct a business model assessment to identify new opportunities, and prioritize key actions needed to weather the crisis. Drawing on these tools, many entrepreneurs identified new distribution channels, shifted marketing and sales online, and added new products and service offerings to meet new opportunities.

In Peru, for example, small- and medium-sized businesses in one TechnoServe program had increased their sales by 81% and improved their employment levels by nearly 50%—just two months after they began following the crisis toolkit.

In the absence of a predictable business environment, time-tested guidance on how to maintain a viable level of sales often meant the difference between an enterprise surviving and succumbing to the COVID-19 crisis.

Below are examples of small business market solutions that proved effective this year:

Supply

Supply Challenges

Just as the coronavirus disrupted businesses’ access to their customers, it also disrupted their access to supplies. Slowdowns in border inspections and international shipping made it difficult for businesses to receive imported materials, while local supplies were delayed by travel restrictions and other transportation complications. At the same time, businesses faced rising prices for many goods as transportation and production costs rose and most emerging-market currencies weakened against the US dollar.

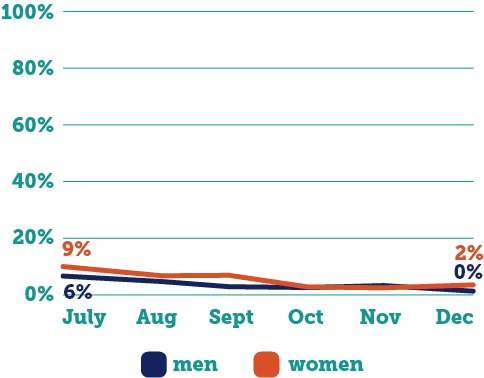

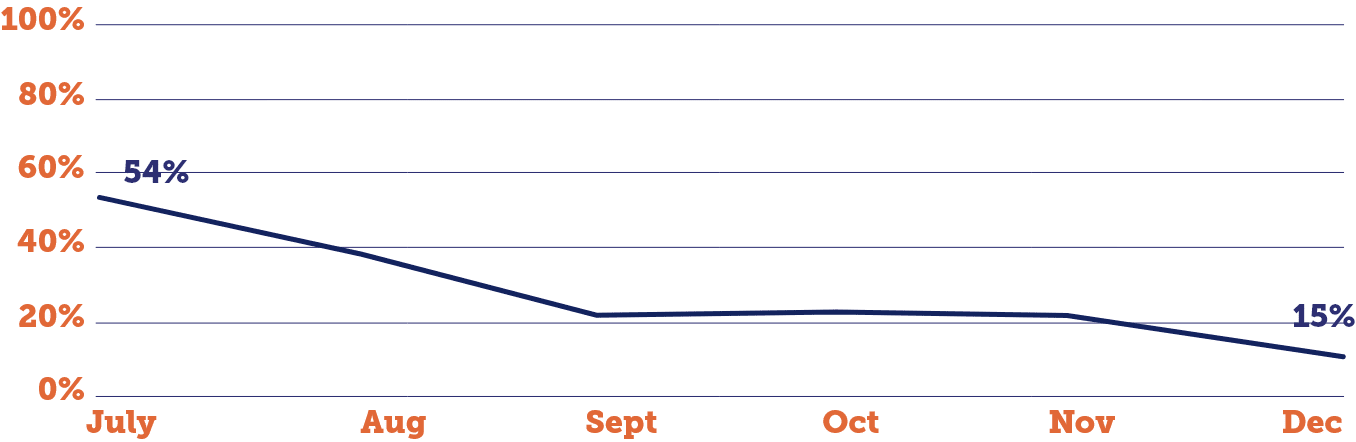

More than half of entrepreneurs reported COVID-related supply disruptions in July, a share that fell consistently over time as restrictions eased and entrepreneurs adapted. Micro-retail shops, which mainly sell food and other consumer goods to local customers, seemed to recover more quickly from the initial supply disruptions. This is due to factors such as many governments’ prioritization of support for food distribution activities and micro-retailers’ generally lower reliance on imported supplies.

Still, 15% of all entrepreneurs surveyed were still having COVID-related supply challenges at the end of 2020, affecting their ability to maintain inventory and sales at a level that could help recover business losses from earlier in the year.

Supply Solutions

Identifying suppliers and service providers is an essential skill for entrepreneurs and is included in TechnoServe’s business training programs. With the disruptions caused by the pandemic, however, some programs had to incorporate additional activities to facilitate new linkages between suppliers and businesses owners.

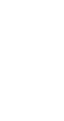

Digital solutions became especially useful in light of social distancing and travel restrictions. Rather than introducing new systems, TechnoServe often helped entrepreneurs apply technology they already used and understood to new ways of doing business. In Kenya, for instance, TechnoServe worked with entrepreneurs to use WhatsApp groups and other digital platforms to connect with new suppliers and exchange information about good deals on products for their shops. These digital connections helped enterprise owners continue operations in the face of rapidly changing business conditions.

As one shopkeeper in Kenya reported:

“My trainer has connected the shop owners in my region with different suppliers and manufacturers, making it easier for us to get the products we weren’t getting from our usual suppliers.”

– Caroline Moses, shop owner (Nairobi, Kenya)

Finance

Finance Challenges

The coronavirus pandemic has both increased small businesses’ need for capital and decreased the amount of commercial financing available to them. Shutdowns and slowdowns in sales reduced the capital available for entrepreneurs to pay salaries, rent, and other fixed costs. At the same time, the uncertainty around the economy and the risk of business failure have made banks and micro-finance institutions less willing to lend money to these enterprises.

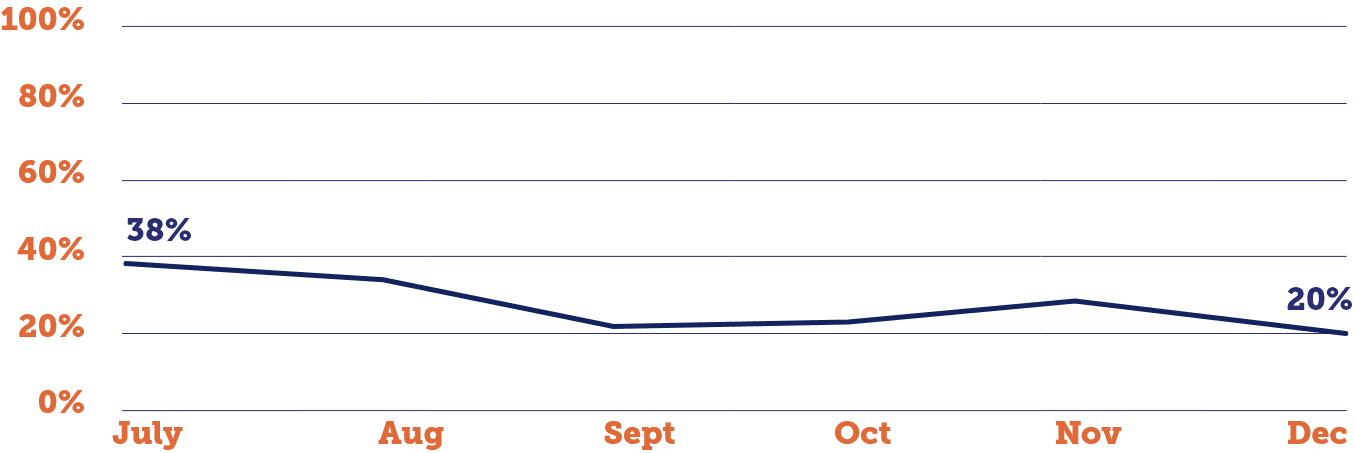

In July, 38% of entrepreneurs surveyed by TechnoServe reported difficulties with access to finance. As businesses adjusted their models and sales recovered, that percentage fell to 17% by January 2021. But this means that nearly one entrepreneur in five still had unmet needs for financing almost a year after the crisis began.

In the absence of commercial lending, entrepreneurs have turned to various strategies to keep their businesses afloat. Many have halted investments or cut expenses, with potential long-term negative impacts for business growth. In other cases, entrepreneurs—and particularly micro-retailers—have turned to informal lenders to access working capital. These informal loans tend to come with very high interest rates and none of the protections associated with formal bank transactions.

Finance Solutions

TechnoServe’s entrepreneurship programs have taken a two-pronged approach to addressing the access to finance challenges caused by the crisis. First, as part of the crisis toolkit, business advisors are helping entrepreneurs evaluate their costs and identify ways to save money without jeopardizing recovery and growth in the future. Once firms understand their break-even point, they can make decisions that save money while ensuring business survival, such as foregoing commercial space in favor of operating out of the home.

TechnoServe is also working with a variety of stakeholders to ensure that firms can access emergency funding and put it to effective use. Governments, foundations, and the private sector have recognized the dire situation facing many small businesses and have created emergency funding vehicles. However, these relief efforts are often most effective when coupled with technical assistance that provides entrepreneurs with the skills and tools needed to weather the crisis.

Below are examples of small business finance solutions that proved effective this year: