COVID-19's Impact on Food Processor Business

Markets

Market Challenges

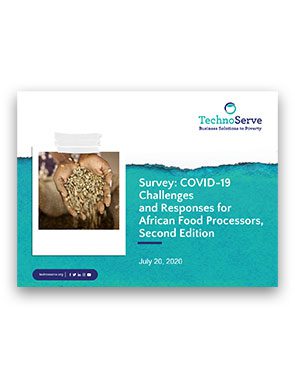

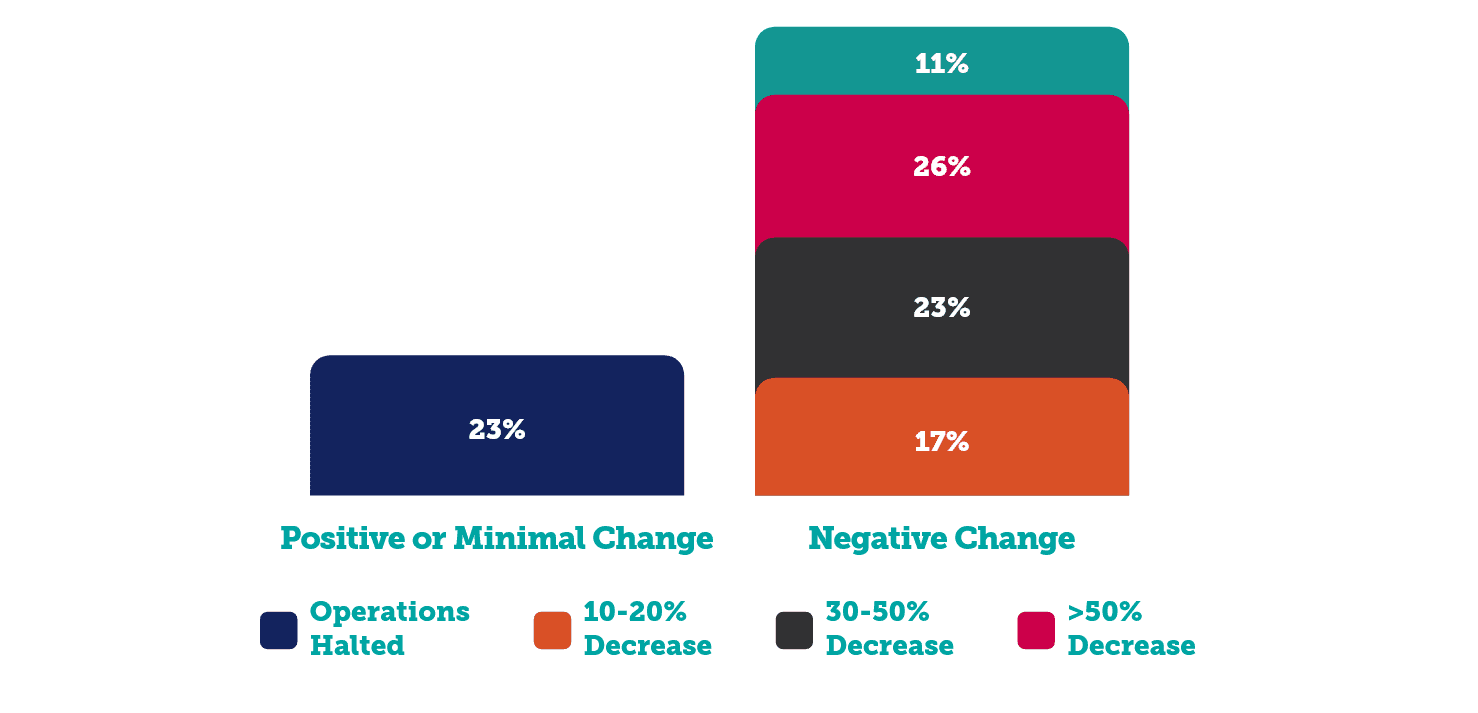

Pandemic-related shutdowns in the spring of 2020 had an immediate impact on sales and distribution of food products for African food processors. In an April survey, 60% of processors surveyed reported that their market distribution activities dropped by at least 30%, with over one in 10 processors reporting that their market distribution had stopped entirely. Accordingly, 56% of processors said their sales had dropped at least 30%, with 14% experiencing a total sales stoppage.

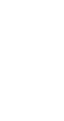

The problems continued in July, with 75% of firms reporting market distribution and sales challenges over the past month. Those heavily dependent on school meal programs and the hospitality market were most affected, as were those dependent on time-sensitive distribution and cross-border trade. The dairy industry was particularly affected by market closures, changes in customer behavior, and the added challenge of moving a perishable product. Reduced consumer spending power and shifting preferences (for example, towards longer-lasting, more shelf-stable goods), further complicated the sales environment for many firms.

While processors scrambled to meet these challenges in creative ways, nearly half also reported that they were scaling back operations in response. Given processors’ position in the supply chain, these actions generate ripple effects across the market. The longer these firms are buying and selling less than usual, the more smallholder farmers supplying them will suffer decreased income, while African consumers will encounter a less diverse and nutritious selection of food in stores.

Market Solutions

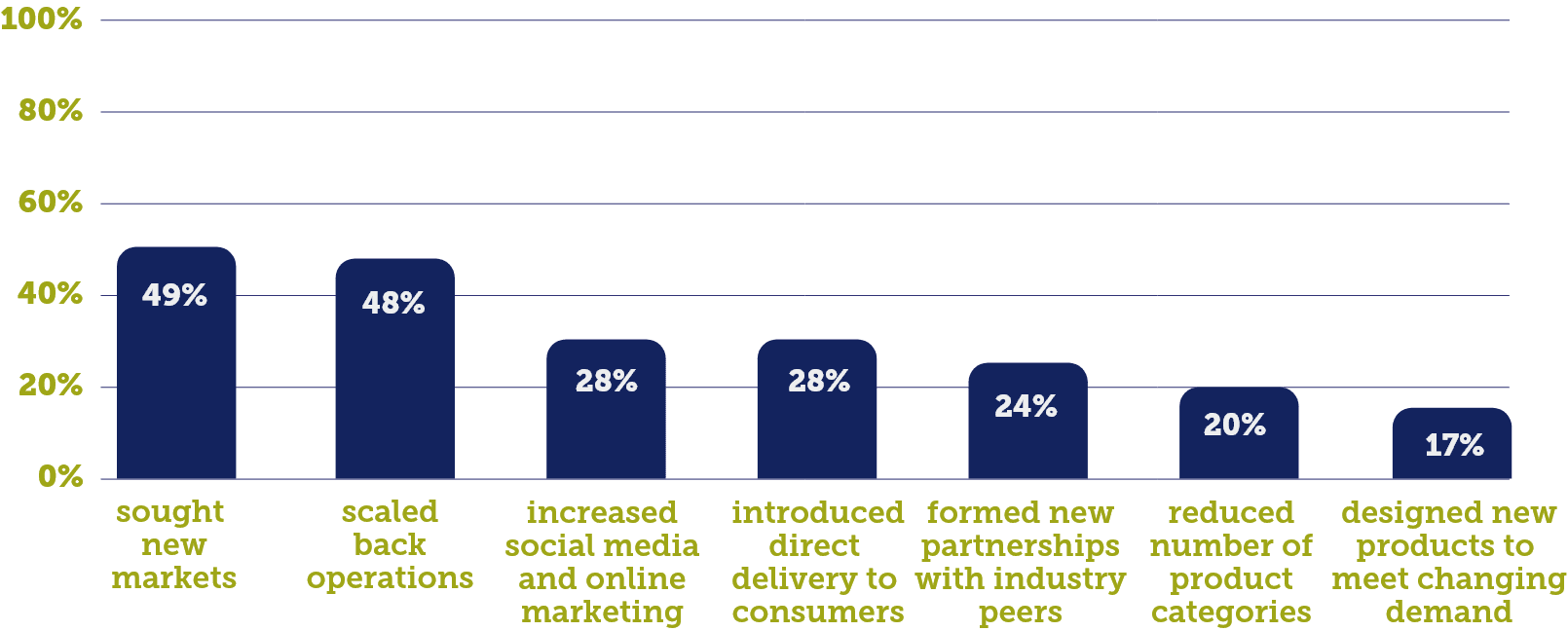

To meet the challenges of a rapidly shifting market, TechnoServe helped processors analyze the current business situation and identify new opportunities. Roughly half of processors responded to changes in their current markets by seeking new ones, exploring new product lines or new customer segments to offset lost income elsewhere.

And, echoing a worldwide shift, food processors began to go digital, ramping up or initiating online sales and turning to increased social media and online marketing. TechnoServe worked to connect many processors to apps and online platforms that can facilitate or even grow the firms’ sales in the future.

Many market adaptations—particularly increased use of digital solutions, direct delivery, and new partnerships—will likely outlast the pandemic and continue to grow in importance. Yet given the sustained economic downturn many countries are facing, food processors will continue to need support in developing new marketing strategies and accessing capital, in order to maintain their critical operations at the center of the food system.

Supply

Supply Challenges

The same shutdowns that crippled sales for many food processors in April 2020 also hurt their supply chains. Seventy percent of firms said that they were experiencing major disruptions to their supply of raw materials, such as grain with which to make flour—a slightly higher share than had reported having significant market distribution challenges.

Although the problem had eased somewhat over the following months, 63% of processors still reported in July that they had experienced supply chain challenges in the previous month. Transportation costs had significantly increased, due to check-point delays and health precautions, and some companies supplying the processors experienced temporary shutdowns due to coronavirus outbreaks among staff.

The most acute supply chain challenges eased toward the end of the year—and even with the lingering threat of resurgent outbreaks and lockdowns, many processors have now made adaptations and contingency plans that may improve their resilience to future disruptions.

Certain supply problems, however, are likely to continue in the coming year. International travel restrictions have continued to delay imports of machinery and other materials from countries like India and China. And in 2020, East African farmers not only experienced locust infestations and drought conditions, but in many cases also faced pandemic-related financial and supply challenges. As a result, food processors may have future trouble sourcing adequate supplies from local farmers.

63%

Of African Food Processors

Reported Supply Chain

Problems In July 2020

“We have an inability to access raw material due to the lockdown, and have run out of stock to sell to customers due to the inability to get raw material to produce.”

– Edible Oil Processor, Nigeria (July 2020)

Supply Solutions

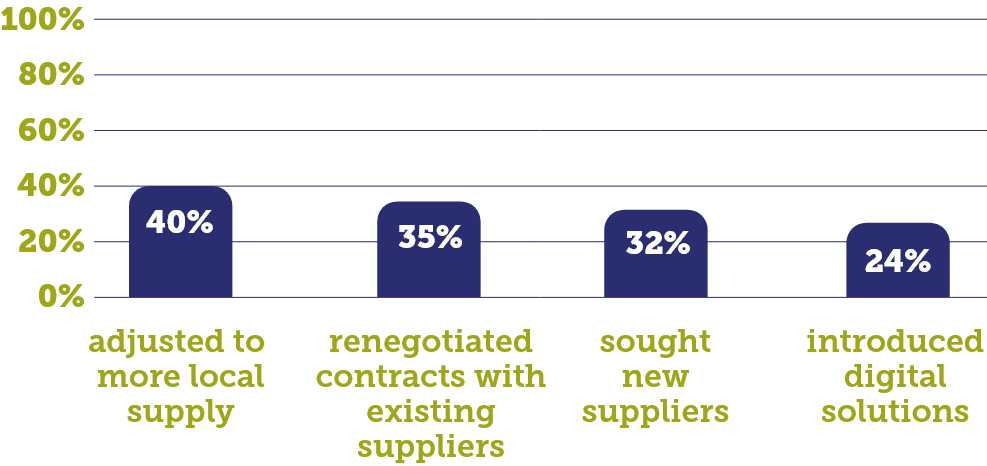

Securing raw materials was a major problem for many African food processors, even months into the pandemic. Given the processors’ position in the middle of the supply chain, their struggle reflected and compounded other market problems. Smallholder farmers couldn’t overcome transport and supply chain disruptions to sell enough crops to processors, and the processors had trouble accessing materials from packaging to essential nutrients with which to fortify staple foods.

To improve connections with farmers, TechnoServe worked across East Africa to help processors determine their sourcing requirements and identify promising suppliers. In Tanzania, for instance, this support helped four processing companies connect with more than 160 smallholder farmers and aggregators, resulting in the sale of over 1,000 metric tons of goods per month from farmers to processors, benefiting both parties at a critical time.

Technology also helped companies surmount supply chain challenges, with about a quarter of surveyed food processors adopting new digital solutions to help source raw material.

In the future, greater “upstream” investments by processors in their supply chains—from greater direct engagement with crop aggregators to input subsidies for farmers—could lessen risks from future crises.

Finance

Finance Challenges

As the COVID-19 crisis worsened, African food processors faced mounting financial strain. Many saw their capital reserves plummet in the face of diminishing revenues and increased operating costs, jeopardizing their ability to maintain payrolls and buy raw materials.

At the same time, financial institutions reduced their lending in the face of growing economic uncertainty.

In July, 40% of processors reported challenges accessing finance in the previous month. Forty-three percent had sought financial support from financiers or government relief programs—many unsuccessfully—while about a third had renegotiated the terms of their loans with creditors. Many processors reported that banks were too slow in their responses and reluctant to expand their risk with additional loans. Many were still even physically inaccessible.

As COVID-19’s economic fallout continues, several processors that managed to stay afloat in the past year may not be so fortunate in the future. Each successive business challenge can strain already struggling enterprises to the breaking point. When this happens, the loss often ripples beyond the processor’s immediate business circle to the wider community. Many remote areas often rely on a single nearby processor for staple foods such as bread or milk. When that facility goes out of business, the community will struggle to access those same foods, losing an important source of nutrition in their diet.

In this way, the financial cost of helping a business survive the pandemic ultimately may be far less than the cost in financial, social, and health terms if the company shuts down.

40%

Of African Food Processors

Reported Problems Accessing

Finance in July 2020

Finance Solutions

Helping processors navigate the complexities of financial assistance proved instrumental in unlocking capital. TechnoServe worked with processors to develop the business case for financial proposals to lending institutions that resulted in loan restructuring and grace periods for repayment. Other processing companies were able to secure capital for extension services to their suppliers, enabling the processors to quickly address a shortfall in raw materials.

Still other food processors were supported in their efforts to access a range of government and external funding assistance, including a “resiliency” grant from the Coalition for Farmer Allied Intermediaries (CFAI), a consortium formed by Partners in Food Solutions, TechnoServe, Bain, and Root Capital, with funding contributions from Cargill and the U.S. African Development Foundation.

A range of other creative solutions can limit lenders’ risks while ensuring the survival of important businesses like food processors—from loan guarantees to concessionary loans to blended finance mechanisms. Donors and lenders of all stripes should recognize the potential failure of these businesses as the crisis situation that it is, and act quickly to stave off greater financial damage in the future.